. . brings a decentralized and democratic economic platform to the real economy!

. . brings a decentralized and democratic economic platform to the real economy!Cloud Capital Chamber of Economies Cloudfunding CloudfundMe Buyers Crowd Sellers P2P Groups Places SignUp

DeLE Markets FOMEZ GPEUN LED - Hubs Global Markets GOMTX Economic Engine FDC DFDC UDC PriceDemand UDI Cloudfunding Main St

| Cloudfunding is the economic infrastructure behind modern Commerce | |||||||||||

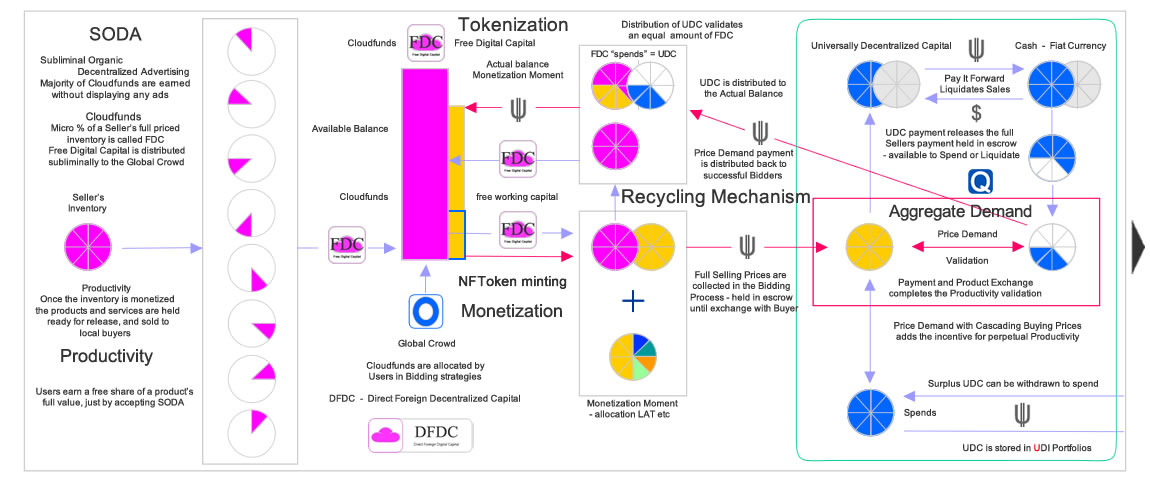

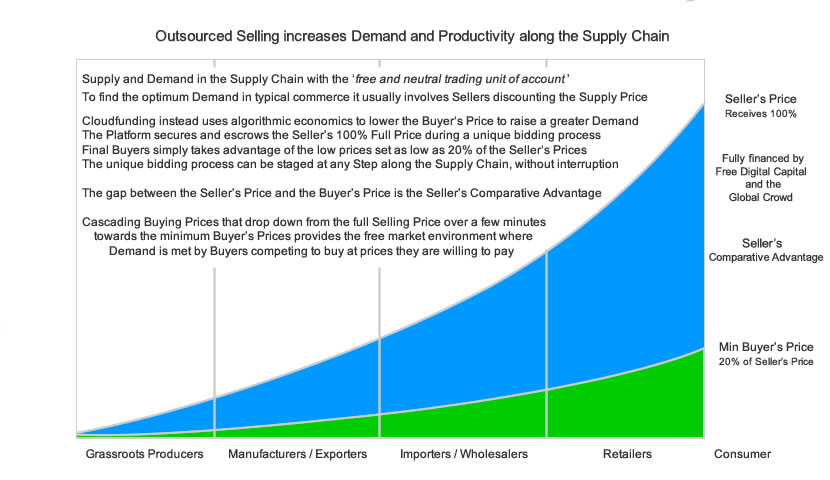

| Cloudfunding operates from local grassroots suppliers through supply chain sellers to global consumers - it disrupts market incumbents ( rent seekers ) with advanced Commerce and Technology - ComTechX the Industry, challenges how global markets are controlled by a few, and instead offers an open market operating system with a global economic trading platform that's value-based and governed by a democratic global consensus to constantly find real-time demand - based on what the world wants to pay, not middlemen. Cloudfunding is a cloud-based economic ecosystem that sits above the Commerce level as a neutral Operating System - OS, maintaining secure financial independence of Users - it freely provides the mechanics for Sellers to Outsource the Selling of their products and services on a global scale in a unique process that fully monetizes the Seller's full Selling Prices - it incentivizes an independent global network of market makers to form the new digital workforce that democratizes global productivity - it interconnects and shares the economic growth and wealth from local and global productivity through economy to economy trade - e2eCommerce. The economic value in local economies has traditionally been viewed as a result of the efforts made by the banking and financial industries that have controlled the flow of capital across the economies, mainly by using past data and trying to predict or influence the future movement of capital with interest rates and access to credit - Cloudfundings' economic model doesn't use future expectations and crystal ball economics, instead it taps into the existing economic values sitting in local economies in real time, and draws on the economic values and uses that genuine value to stimulate the commerce activity in supply and demand of products and services throughout local economies around the world with new digital technology that interconnects economies on a global public economic utility network. Cloudfunding brings a new Gold Standard into the digital economy Cloudfunding works within the Global Open Market to Outsource the Selling of products and services to an incentivized global crowd - it operates in an ecosystem that taps into global productivity using a neutral economic trading unit of account value to generate uninterrupted demand on a global scale - it directly stimulates local economies by disrupting the status quo - it pushes aside currency exchanges to neutralize any spread between the various currencies by aggregating a basket of global currencies in real time to validate a stable neutral international trading unit of account currency - automatically solving liquidity between global currencies in trade. Having Gold as the central value of any global economy is unrealistic in modern economies, it's susceptible to constant manipulation by traders and countries - whereas a global Productive Standard, distributed as a neutral international trading unit of account, is a genuine democratic value for the New Digital Economy - an economic value that's tracked down to 14 decimal points in real time across all currencies and countries, so seamlessly, that digital cash is now ubiquitous, due to the global exchange of ownership platform that securely tracks ownership of value as it crosses borders. A new formula for scale and sustainability Cloudfunding changes the flow of modern Commerce to: Productivity > Distribution > Free Digital Capital - bringing online a new wave and generation of Commerce that's capable of generating predictable sales with Outsourced Selling and delivering a genuine real time Price Demand for products and services - directly linked back to Users filtering algorithms to customize their needs - it's more serendipitous, without the targeting. Online distribution has become stagnant and dominated by a generation of gatekeepers - what Cloudfunding does is bypass those incumbents to focus on inventory sales for Sellers, and part of that is with Subliminal Organically Decentralized Advertising - forming a distribution network incentivizing Sellers to list and be guaranteed to sell inventory to Buyers without discounting or incurring costs - and then for Buyers to gain greater buying power without fees - the infinite loop continues with a location activity tax drawn from the productivity, getting distributed into user portfolios to share the economic growth of the various productive locations, ready to spend on further products and services. |

|||||||||||

| Outsourced Selling drives perpetual demand | Real-time trade sustains local productivity | ||||||||||

|

|

||||||||||

| Markets with an economic value-based ecosystem Local productivity has a history of being dictated to by fluctuating global commodity pricing that effectively has major consequences at the grassroots level of industries and societies - Cloudfunding disrupts those incumbents by challenging the status quo - Commerce's ultimate goal should be an economic value-based universal mechanism between Supply and Demand, so there's more equality and fair distribution of productivity wealth up and down the supply chains. Cloudfunding is democratizing global productivity by providing the digital tools for users in developed countries to deleverage from the grip of a dysfunctional financial system set in the old economy, tools so they can transition seamlessly into the Digital Economy - while simultaneously providing tools for users in developing countries to operate on the same level playing field, and avoid being trapped in the old economy. Cloudfunding doesn't create money, it digitally aligns with local currencies in local economies and perpetually stimulates the flow of economic value in a neutral Capital through new economics that are controlled by a decentralized and democratic consensus, using Productivity as the leading catalyst - with the end focus of increasing the economic growth in those local economies. Global industries and markets - new dynamics With the world commodity markets being thrown around by instability in the financial markets, it shows fundamental differences between market economies and the real global productive economy - there's a contagion effect flowing across from the financial sectors to other global markets scrambling to justify prices in the true productive economy - this new norm environment is poised to continue to harm individuals and industries for years to come if the world doesn't solve two main issues, how to gain more productivity and do it without adding debt. Bretton Woods proposal revisited with a modern influence Cloudfunding brings together a digital reality to a concept that has a similar ideology to one that was conceptualized by the famous British economist John Maynard Keynes in the early 1940s, who as head of the British Treasury presented the concept as the official British proposal at the Bretton Woods Conference in 1944 - a proposal that there "be a unit of account used to track international flows of assets and liabilities" using a neutral central mechanism using gold as a base value - the US Dollar theoretically tied to the gold value however was accepted as the 'unit of account' at the time due to the overwhelming influence that the USA had with its enormous trade surplus after WW2, and it become known as the Bretton Woods System - that connection with the US Dollar and gold was abandoned in 1971 through political influence and market limitations, an outcome which sent the world economies on many wide rides that are still being experienced today. Keynes's Bretton Woods Conference proposal was modeled and limited around what was achievable at the time - the proposal was " . . bancor would not be an international currency. It would rather be a unit of account used to track international flows of assets and liabilities. Gold could be exchanged for bancors, but bancors could not be exchanged for gold. Individuals could not hold or trade in bancor. All international trade would be valued and cleared in bancor. Surplus countries with excess bancor assets and deficit countries with excess bancor liabilities would both be charged to provide symmetrical incentives on them to take action to restore balanced trade . . as the way to overcome economic slumps and depressions when monetary policies proved ineffective". source: wikipedia ComTechX is disrupting the status quo of trade with Cloudfunding with a universally free neutral global trading value termed as Free Digital Capital - it's part of the cloud-economics ecosystem it applies practical steps at the micro-economics level to influence macro-economics change, it offers a new frontier in global commerce and trade with new dynamics that stretch from local commerce to value-based global trade - Cloudfunding reverse engineers the online advertising model and instead of allocating a percentage of a product's value for advertising, Cloudfunding allocates the full 100% selling value of a product or service, and through a transparent process validates the full product value as a free digital asset class unit of account - this value is subliminally distributed in small micro-values and shared freely with global users as a neutral global economic trading value - anyone can collect these micro-values and use them collectively as working capital to help generate global productivity, and gain a benefit for themselves - this free digital global economic trading unit of account is 100% validated through a recycling mechanism that uses aggregate demand of global productivity to anchor ( and gain intrinsic value ) against the real productivity value of products and services sold into the local economies - the global economic trading unit can seamlessly jump borders to stimulate supply and demand in foreign economies and be tracked in a Balance of Payments mechanism where the global users can be updated with real time data that can incentivize users to directly stimulate local productivity - this free market trading environment is a deleveraging tool that can reduce national and private debt. From a concept almost lost in time to today's reality Keynes could not have imagined that todays' digital technology could bring the proposal he introduced at the Bretton Woods Conference in 1944 into a reality more than seventy years later, with bancor being transformed into a digital form and distributed globally as a free neutral international trading unit of account - instead of it being controlled centrally by an institution, it's distributed freely to the users of the Internet in local economies to collect and use seamlessly as free working capital across country borders to stimulate local economies - it begins as Free Digital Capital before being validated as Universally Decentralized Capital - as a neutral international trading unit of account. This free global trading unit of account needs no capital to be held ( as in holding gold or fiat currencies ) or have any need to transfer fiat currencies between countries ( so there are no fees and currency spread rents/ransoms gained by incumbents controlling national fiat currencies ), or need for currency values to be speculated with, or manipulated to gain a trading advantage, or even be involved with capital account convertibility, combined - these are overall some of the main causes of the economic slumps and depressions. This global trading unit of account takes away any of the issues of a trade surplus and deficit by having a democratic Balance of Payments mechanism that is controlled by global users, who have the incentive of acting in real time to balance trade ( productivity ) between local economies domestically and internationally without hindering sovereign currencies as there is no international flow or balance of liabilities involving international currency reserves, only the economic values in local economies - with Cloudfunding, there's no change in the balance of trade in the national currency accounting ledgers when products and services are transferred physically and digitally between countries ( economy to economy - e2eCommerce ), as there's no national fiat currencies held or transferred across borders between countries or individuals. Cloudfunding operates in a new paradigm above B2B and B2C, it operates from economy to economy with e2eCommerce spanning across the world in a seamless flow of supply and demand between local and global Buyers and Sellers exchanging asset ownerships and settling liabilities. Cloudfunding gives the Internet its ubiquitous financial freedom The New Economy is the digitization and democratization of the commercial flow of value through Global Trade and Commerce using digital technology to track a neutral international units of account, which in some way is the digitizing of what the IMF have tried with SDR - SDR is a restricted Special Drawing Rights value - a foreign-reserve currency also termed as XDR, which is created like quantitative easing but without printing money or have any true backing - its objective has been to replace gold and US Dollars - its role is for IMF member countries to draw down the SDR ( which is really printed money with the backing of the IMF, not gold or anything tangible ) and sold at various costs or distributed so it can be exchanged between trading countries to balance trade surpluses and deficits. What the New Digital Economy does with Cloudfunding, and in particular with DFDC - Direct Foreign Decentralized Capital, is distribute the Free Digital Capital ( which is the economic value tied to local products and services held by sellers in local economies - this economic value is the genuine global productivity and validated into UDC as local productivity is sold ), allowing it to be globally collected and used as working capital at the local level by individual users in local economies, where it can be fully democratized across local and global trade ( compared to the limited use of SDR which is only available to countries ) - FDC and UDC has a decentralized controlled architecture and so removes the incumbents and opens up global economies to free open markets with an interconnecting ubiquitous flow of a neutral international trading unit of account value - making it freely available for the people of all countries to influence and operate in real time across the real economies. With the internet becoming the largest of any communication system the world has ever seen, it provides the scale and viral effect to enable free digital capital to spread exponentially around the world through the tapping of the largest resource in the world, laying the foundation in local economies where the velocity of local productivity can spread across borders and scale global productivity and maintain sustainable economic growth, all driven by a viral network of users wanting better than what the legacy systems can offer. Global Chamber of Economies is born Cloudfunding is a global economic and financial ecosystem with three distinct phases, productivity, democratic distribution and free digital capital, whereas in the Banking financial model it begins with debt, then distribution, followed with productivity - as the free global trading unit of account, FDC clears the barriers seamlessly as it crosses borders via the Direct Foreign Decentralized Capital - DFDC ( to pay full selling prices directly into the seller's business and local economy ) - it's drawn from a democratically incentivized global crowd ( future digital workforce ) that uses the FDC as working capital to stimulate productivity in economy after economy, for free - whilst being validated into UDC - as the neutral Universally Decentralized Capital and international trading unit of account. With the decentralizing of local economies it offers individuals and the local Chamber of Economies the means to influence industries in local economies to supply products and services so that the economic value of a local economy can be used to draw DFDC into a local economy to help generate economic growth - a Balance of Payments structure helps local users and CoE to track real time flows of economic value as it moves from economy to economy. UDC is the global Digital Cash that's genuinely, and not just theoretically, tied to the global resource based market productivity, in real time. It's validated constantly against a basket of national fiat currencies for comparison to maintain a stable global neutral value, it operates as a parallel money system that can't be speculated or manipulated with, one that enables it to be exchanged in real time, free of fees, charges and currency spreads, one that allows all boats to rise together - Cloudfunding is a new frontier in global commerce and trade that's digitally linked to a concept imagined more than 70 years ago . . Cloudfunding is the dynamics in the new Digital Economy operating in its own Global Chamber of Economies. |

|||||||||||

|

|||||||||||

Using ransom as a tool to control national currencies will disappear early this Century FDC represents a globally free Direct Foreign Decentralized Capital of trading units of account that tracks the international flows of value-based supply and demand in real time, in minute detail, in data that countries, cities and industries can respond to with almost immediate effect by directing increases or decreases in supply to domestic consumption or exports - it's less complicated and more effective as a globally free flowing ecosystem than the other Bretton Woods proposal that lingers and stifles global productivity today - and instead of being limited to gold's speculative value and capital Capital Investment flows and rates, the globally free digital trading unit is fully tied to the global resource based productivity that operates in value-based markets with genuine products and services - it's this that becomes the natural incentive for citizens in countries, regions and industries to be pro-active in generating local productivity with DFDC drawn into a region, similarly local productivity can be generated by local communities using DFDC that's constantly validated against foreign productivity in real time - e.g. a local industry can be perpetually driven by it's own broader community, along with the global crowd, expanding the market footprints to include the local production costs - whenever free DFDC generates local productivity it helps that country's tax revenues ( from full selling prices ) to increase without needing to use any economic policies to gain the advantages. The free and neutral global trading unit of account has a number of unique attributes in that it can operate globally without creating debt via credit or needing interest rates ( to create inflation ) to gain economic growth, and it naturally avoids the liquidity trap - "like when injections of cash into the private banking system by a central bank fail to decrease interest rates and hence make monetary policy ineffective. A liquidity trap is caused when people hoard cash because they expect an adverse event such as deflation, insufficient aggregate demand, or war. Common characteristics of a liquidity trap are interest rates that are close to zero and fluctuations in the money supply that fail to translate into fluctuations in price levels". |

|||||||||||

|

|||||||||||

Automatically flows into Universally Distributed Incomes ( UDI ) In the 'wealth effect' model used in most developed countries which uses inflation of prices to increase the 'wealth' amongst communities, like having real estate inflate prices to give the effect that the economy is going well, the ComTechX Platform gives the New Digital Economy a more authentic value to flow back into communities that can directly give the Users true real time value - and it's all done through the distribution of the Location Activity Tax across unlimited economies, without needing the inflation of prices or interest rates to gain economic growth, Cloudfunding with Outsourced Selling and DFDC it happens naturally and democratically. With all commerce activity on the Platform each product and service that's processed with Outsourced Selling and Buying activity - it's linked back through to the Universally Distributed Income ( UDI ) Portfolios from where all Users can build a collection of Location Tokens and gain a share of the Location Activity Tax collected and distributed across all the global activity in real time. Value-based trading is an important step back The advantages of connecting to genuine value-based trade is that it's so democratic in the way it's universally exchanged and held individually by buyers and sellers - that it operates in real time without needing credit terms, it operates autonomously without there being any need for or connection to central agencies or markets that could interfere or have any conflict of interest with speculation - as was the case in Keynes' time when banking was forced to operate separately from market speculation - an Act forced in by President Franklin Roosevelt so that the world economies could recover from the Great Depression ( Glass–Steagall Act - U.S. Banking Act of 1933 that limited securities, activities, and affiliations within commercial banks and securities firms . . forcing commercial banking to operate separately to Capital Investment banking . . melted down over time and finally repealed by President Bill Clinton in 1999 ). source: wikipedia With President Clinton being the one to officially end the Glass-Steagall Act, it's so ironic that it was he as President who gave the rise to the Internet by giving it freely to the world - that act alone opened up avenues that the world had never experienced before with the means to connect and share information - it was at that time that ComTechX's early beginnings began to form around what President Clinton gave to the world - the opportunity to help restructure a fairer world by being able to build the new digital economy that streamlined mechanisms that have often hindered economic progress for so many in the world, by giving the global crowd a say in their economic well being - it will be an end of an era when banking institutions used the money flow and interest rates to control economic growth, and it will shift exponentially to the new digital era where real time activity will have sustainable growth in economies, driven by productivity governed by the needs of the people. In the relatively short period since the Internet began, there has been an acceleration of events that may not have been possible before - events like the Arab Spring, the ousting of governments and dictators, and certainly the Internet helped in pushing forward the financial crisis that still grips the world today - the patchwork to help cleanup the mess from the GFC has only exacerbated the deep economic issues that are now being played out today in the political arenas in many developed and developing countries - much of the discontent is about inequality and unfairness that the majority of people feel towards the institutions that have been tilting the system against them - and falling behind those with the means to keep up with the system by riding the gravy trains fueled by the speculative commodity markets and financial systems, that history has already shown was a bad cocktail mix - the world is well into the denial phase and if there's no change . . it will not end well! International trade has its own neutral trading unit of account With the culmination of events that lead up to today's unstable financial system and the low productivity around the world, which undeniably stems from the lack of working capital available to business that's held back by the risk associated with lending - the monetary theory about balancing the risk of lending ( using double entry book keeping to create money ) to a business is wavered and bypassed with Free Digital Capital when it's distributed for free around the world - it doesn't conform to the mainstream economic thinking taught to economists and monetarists, nor does it need to either, their thinking of digital technology has only ever been to use it to enhance the leverage of money and extract more value from economies by lending and trading money. As a global trading unit of account, Free Digital Capital is able to be distributed equally and efficiently to global communities, and still be trackable internationally as it flows seamlessly across borders to help generate productivity, it offers the way for value-based global markets to achieve sustainable growth - it provides all and more than the method of lending money at a cost to force inflation and growth - as a free global trading unit of account it's able to expand the overall footprint of the Supply and Demand with products and services, helping to keep in order the checks and balances needed to monitor assets and liabilities in all size economies. Value-based markets is the only future for suppliers |

|||||||||||

Cloudfunding solves a long standing dilemma of sharing the cost to produce and financing trade more equitably between suppliers and consumers without the incumbents tilting the markets - Cloudfunding disrupts the status quo with "free and neutral trading units of account that are used to monetize global trade and track international flows of supply and demand in supply chains" . . driven and influenced directly by the Global Crowd. |

|||||||||||

. . as what the invent of coinage did for commerce and trade in ancient times! "

. . and for the people, to trade ubiquitously across global commerce and trade! "

We're opening up to Sellers early, so if your business wants to get 'a competitive advantage', add your details

see the broader details of the Platform

Check out a Deal Registration and Cloudfund Strategy

See a Snap-Shot view of a Cloudfund strategy and bidding for Deals

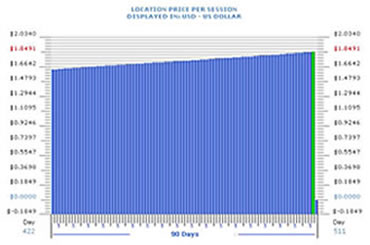

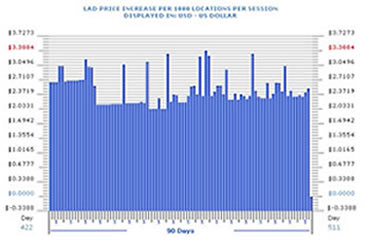

Cloudfunding generates Price Demand - digitizes 'cash' to flow ubiquitously around the world

What's The Monetizing Moment?

Cloud Commerce operates by Outsourcing the Selling to the Crowd by Cloudfunding

How Sellers Outsource their Selling to the Crowd?

As UDC is validated and exchanged in the Digital Economy it permeates out into local economies!

see the connection of players that help achieve 'Productivity' : Global Cloud Productivity

Wherever your Location is - you are not alone!

Contact

Privacy Policy

Terms of Service